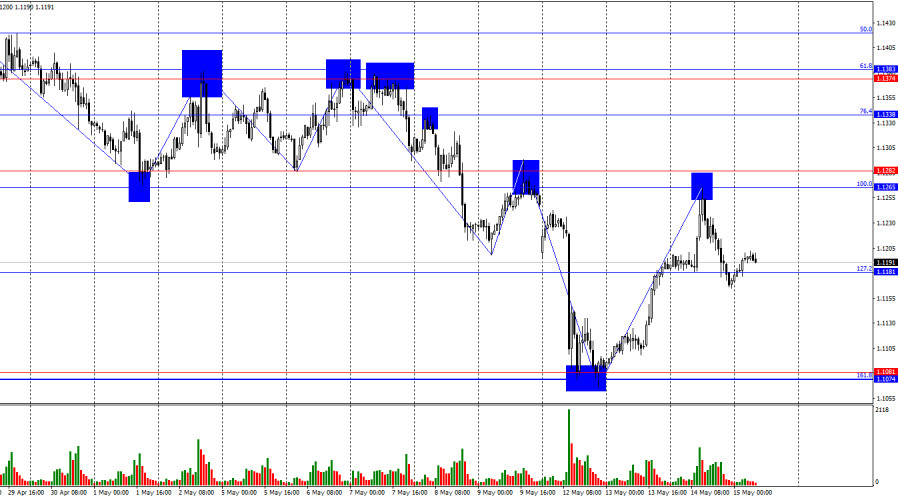

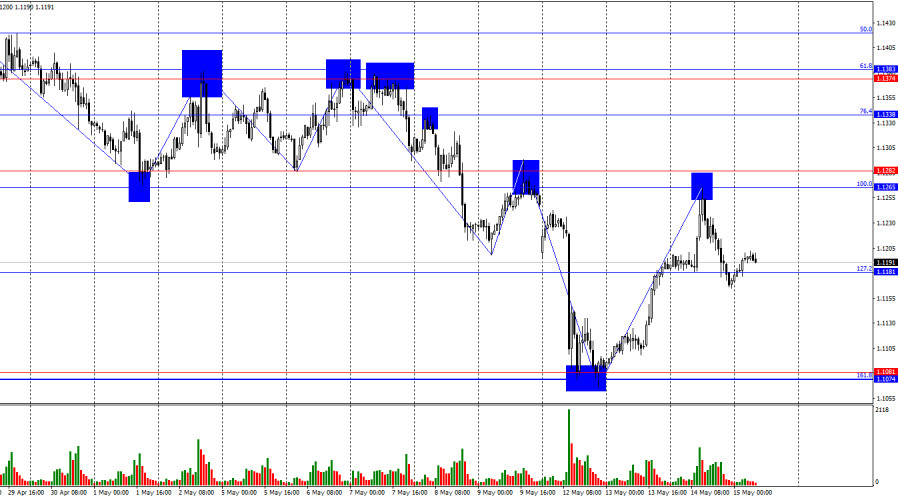

On Wednesday, the EUR/USD pair rose toward the resistance zone of 1.1265–1.1282, rebounded from it, and reversed in favor of the U.S. dollar, which managed to gain about 80 points by the end of the day. At this point, any rise in the dollar is already a celebration. Traders still prefer not to deal with the greenback, as the "Trump factor" is in full effect. In other words, traders are hesitant to buy the dollar, knowing that Trump could introduce new tariffs at any moment. Nevertheless, I consider the current dollar rebound insufficient. A consolidation of the pair below the 127.2% Fibonacci retracement level at 1.1181 would open the way for a new decline toward the support zone of 1.1074–1.1081.

The wave pattern on the hourly chart leaves little room for doubt. The last completed upward wave did not break the previous peak, while the latest downward wave broke the previous low. This confirms a shift to a "bearish" trend. The news of a successful round of U.S.-China trade talks gave bears some support, but they still face many challenges before gaining the upper hand over the bulls.

There was virtually no news on Wednesday, but traders were not taking a break. They continued to respond to the weak U.S. inflation report, which in essence doesn't change the outlook. Jerome Powell stands firm and has no intention of lowering the interest rate under pressure from Donald Trump or due to a slight dip in inflation. Indeed, U.S. inflation slowed to levels where monetary policy easing became a talking point. However, Powell has repeatedly stated that inflation is expected to rise in the coming months, and the Fed cannot afford to loosen policy at this time. Thus, for me, the dollar's drop on Tuesday and Wednesday appears excessive. Still, bears remain weak, as no real truce has yet been reached between the U.S. and China. Only preliminary agreements have been made—agreements that were unavoidable, as trade between the countries would have otherwise come to a standstill. Negotiating from this point onward will be much harder, but the reduction in tariffs is nonetheless a positive sign for both the economy and the dollar.

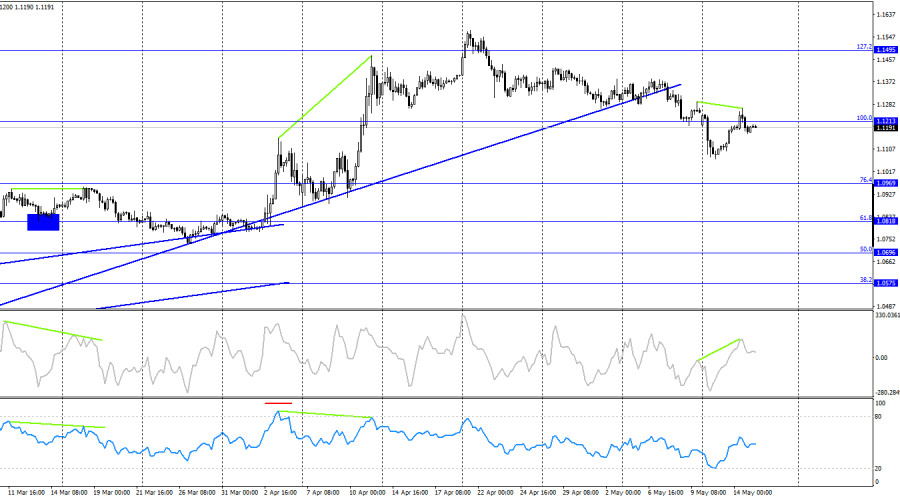

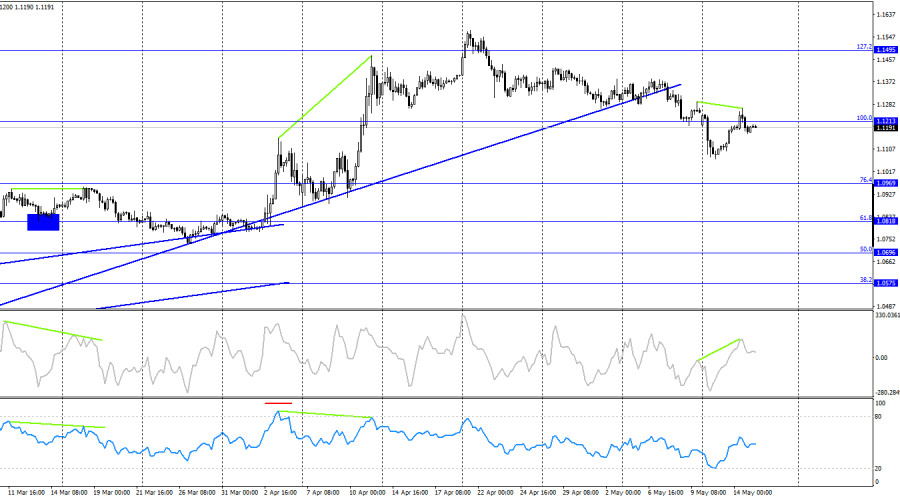

On the 4-hour chart, the pair has consolidated below the 100.0% Fibonacci retracement level at 1.1213. This opens the door for further declines toward the next key support at the 76.4% Fibonacci level at 1.0969. A rebound from 1.1213 could renew hopes for dollar strength. A daily close above 1.1213 would favor the euro and revive the "bullish" trend toward the 127.2% Fibonacci level at 1.1495. A bearish divergence on the CCI indicator increases the odds of a further decline.

Commitments of Traders (COT) Report

During the most recent reporting week, professional traders closed 2,196 long positions and 2,118 short positions. The sentiment among the "Non-commercial" category has long been "bullish" again—thanks to Donald Trump. The total number of long positions held by speculators now stands at 194,000, while short positions total 118,000. A few months ago, this situation was reversed and gave no indication of what was to come.

For 20 consecutive weeks, large players were dumping euros, but they have now been reducing short positions and increasing long ones for 13 straight weeks. The divergence in monetary policy approaches between the ECB and the Fed still favors the U.S. dollar, but Trump's policies remain a more significant factor for traders, as they could trigger a recession in the U.S. economy.

Economic Calendar – May 15 (UTC)

- EU – Industrial Production Change (09:00)

- EU – Q1 GDP Change (09:00)

- U.S. – Producer Price Index (12:30)

- U.S. – Retail Sales Change (12:30)

- U.S. – Initial Jobless Claims (12:30)

- U.S. – Philadelphia Fed Manufacturing Index (12:30)

Today's economic calendar is packed, but the most important data this time comes from Europe. The informational background may moderately influence market sentiment throughout the day.

EUR/USD Forecast and Trading Advice

Sales are possible today with a close below 1.1181 on the hourly chart, targeting the 1.1074–1.1081 zone. Alternatively, a bounce from 1.1213 on the 4-hour chart could be a signal to sell. I would not consider buying yet, as I don't see any patterns today that could generate strong buy signals.

Fibonacci grids are drawn from 1.1265 to 1.1574 on the hourly chart and from 1.1214 to 1.0179 on the 4-hour chart.