The EUR/USD currency pair continued trading sluggishly on Tuesday, maintaining an upward bias. The macroeconomic backdrop has been absent for two days in a row, but there have been some fundamental developments. In the absence of better and more substantial events, the market has started to closely monitor the trade negotiations between China and the U.S., which are taking place in London. We don't quite understand the hype surrounding yet another preliminary meeting between the parties. It's evident that negotiations will be long and tedious, and no one pays attention to Donald Trump's rhetoric anymore.

The U.S. president once again stated yesterday that negotiating with China is very difficult, but at the same time, talks are progressing, and there's a good chance of success. According to Trump, everything is going well everywhere, and it can't be otherwise because America is headed for a great future. Perhaps that future is bright, but it doesn't feel like it right now. The market has shown both on Monday and Tuesday a complete lack of interest in vague statements like "negotiations are ongoing." Only after the talks conclude and official results, such as the lifting or easing tariffs and restrictions, are announced will the market react appropriately. For now, it remains just words.

Traders also remain uninterested in mutual concessions regarding exports of rare earth metals or certain technologies. These matters are expected to be part of a future deal, but traders care about tariffs that impact the bulk of trade between the two nations—not "minor" issues. In short, the only current fact is that negotiations are underway, but no results or information have emerged.

Meanwhile, the dollar continues to depreciate slowly but steadily in the absence of news. Recall that while negotiations with China are important, they are no longer the only problem facing the U.S. dollar and economy. For several days now, mass protests have erupted in many major U.S. cities against Trump's immigration policy, in which he seeks to deport all undocumented migrants "without trial or investigation."

According to U.S. law, if someone lacks documentation for legal residency, it doesn't automatically mean they should be deported. The individual may file a lawsuit, may have lost their documents, or may have other legal grounds to remain in the U.S. It's not as simple as Trump wants it to be, especially in a democracy. However, U.S. court cases can take years, and Trump does not want to wait several years to deport a few thousand undocumented immigrants. During that same time frame, even more will arrive... Yet the unrest, protests, and chaos certainly do not add to the dollar's appeal. Day by day, the situation for the greenback continues to worsen.

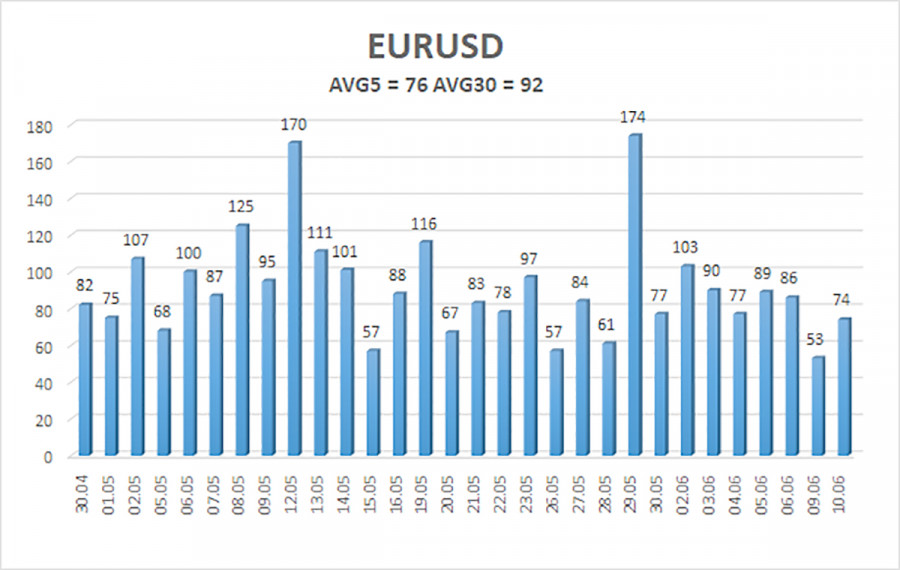

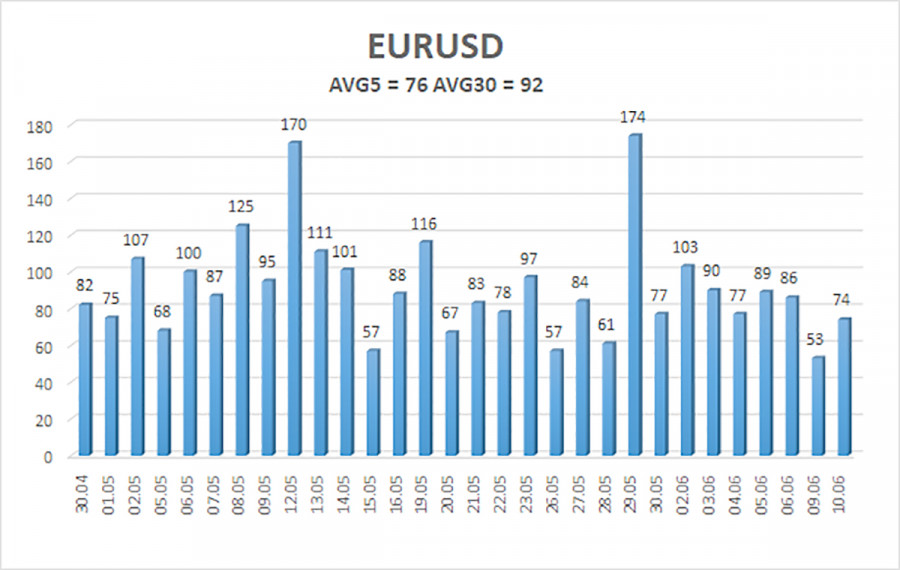

The average volatility of the EUR/USD currency pair over the last five trading days as of June 11 is 76 pips, which is considered "moderate." On Wednesday, we expect the pair to move between the levels of 1.1344 and 1.1496. The long-term regression channel is directed upward, indicating a continued bullish trend. The CCI indicator entered the oversold area, and a bullish divergence formed, triggering the uptrend's resumption.

Nearest Support Levels:

S1 – 1.1414

S2 – 1.1353

S3 – 1.1292

Nearest Resistance Levels:

R1 – 1.1475

R2 – 1.1536

R3 – 1.1597

Trading Recommendations:

The EUR/USD pair continues its upward trend. The dollar still lacks valid reasons for the decline—aside from Trump's policies, which will likely have destructive and long-term consequences for the U.S. economy and the country overall. We thus note the market's complete reluctance to buy the dollar, even when there are grounds to do so, along with near-total disregard for the few positive factors supporting the greenback.

If the price is below the moving average, short positions remain relevant with targets at 1.1352 and 1.1292, but a substantial drop under current conditions should not be expected. Above the moving average, long positions can be considered with targets at 1.1475 and 1.1496.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.