On Tuesday, the EUR/USD currency pair showed a slight decline. The U.S. dollar continues to struggle to gain strength as market participants lack confidence in it. While it was previously argued that only positive news regarding the progress of negotiations with China and the European Union could support the U.S. currency, this no longer seems to be the case.

Please note that the market continues to ignore most factors favoring the dollar. Strangely enough, there are quite a few such factors. First, in terms of annual growth rates, the U.S. economy remains stronger and grows faster than the European or British economies. Second, contrary to traders' expectations, who have been waiting for three years for the Federal Reserve to act decisively, the American central bank continues to lower rates very slowly or not at all. Even Donald Trump's public pressure over several months, including insults aimed at Jerome Powell, the Fed chair, has not helped.

Third, the Fed's monetary policy has become increasingly hawkish relative to the European Central Bank and the Bank of England. In other words, the Fed is cutting rates more slowly than the BoE and much more slowly than the ECB. Still, none of these factors are offering any support to the dollar. Yet no one would seriously claim that these are not bullish factors for the greenback.

Returning to the topic of trade war, it was previously argued that progress in negotiations with the EU and China or easing trade tensions with these partners could strengthen the dollar. The logic is straightforward: if the dollar plummeted dramatically on news of new or increased tariffs, it should rise on news of tariff reductions and trade agreements. However, as practice shows, it all depends on market sentiment, which remains very negative towards both the dollar and Trump.

In other words, no matter what Trump does or what agreements he signs or announces, the market doesn't believe him anymore. Trump frequently changes his decisions, and traders cannot keep up with his shifting mood. Not all market participants are intraday traders. Imagine a large bank building a speculative short position on the dollar after Trump announces higher tariffs on the EU. Then, just a day later, Trump reversed his decision after a conversation with Ursula von der Leyen, in which the head of the European Commission tearfully asked to delay the tariffs until July 9, promising progress in the negotiations.

As a result, the market now prefers not to take risks or rely on Trump's bold declarations. The dollar is sold off after any statement from Trump, and when the news is positive, the reaction is minimal. Even if Trump were to sign a deal with China tomorrow, the market would still expect nothing good from him or the U.S. economy and wants nothing to do with a currency whose issuing country's president changes his mind five times a day.

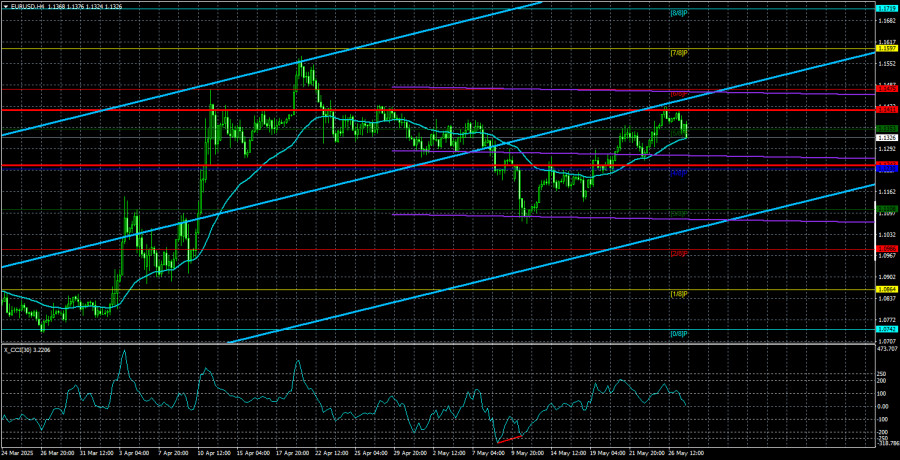

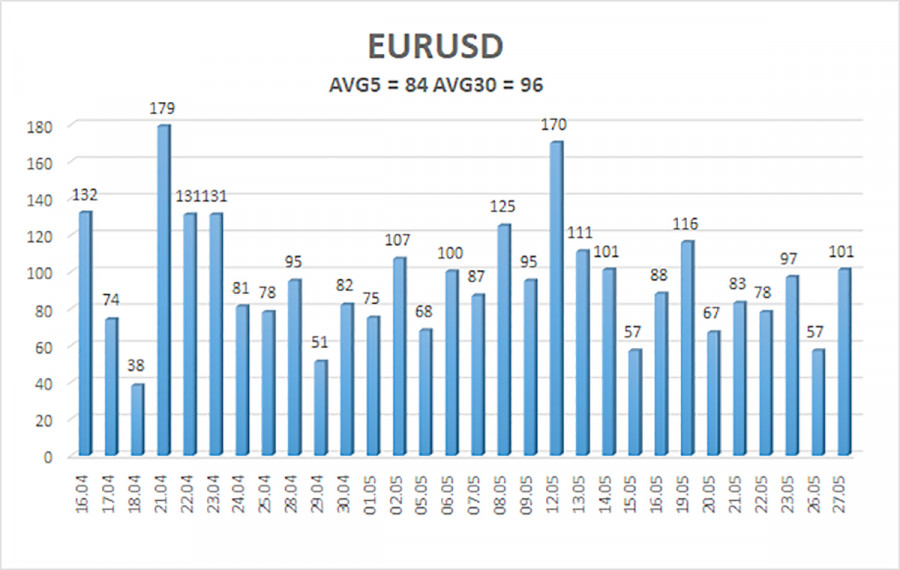

As of May 28, the EUR/USD pair's average volatility over the last five trading days is 84 pips, classified as "average." We expect the pair to move between 1.1243 and 1.1411 on Wednesday. The long-term regression channel is pointing upward, still indicating an uptrend. The CCI indicator entered oversold territory, and a bullish divergence has formed, which, in the context of an upward trend, signals its potential continuation.

Nearest Support Levels:

S1 - 1.1230

S2 - 1.1108

S3 - 1.0986

Nearest Resistance Levels:

R1 - 1.1353

R2 - 1.1475

R3 - 1.1597

Trading Recommendations:

The EUR/USD pair is attempting to resume its upward trend. In recent months, we have consistently stated that we expect a medium-term decline for the euro, as there are still no fundamental reasons for the dollar to weaken—aside from Donald Trump's policies, which will likely have damaging consequences for the U.S. economy. Nonetheless, we continue to observe the market's complete reluctance to buy the dollar, even when valid reasons exist.

Short positions remain relevant if the price is below the moving average, with targets at 1.1230 and 1.1108. If the price is above the moving average, long positions should be considered with targets at 1.1457 and 1.1475.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.