Investors are left guessing: 100 days into Trump's second term

Donald Trump is approaching the first major milestone of 100 days in his second term in the White House, but markets and central banks around the world have failed to adapt to the new realities of his unpredictable rule.

Financial experts are watching anxiously as they try to figure out what exactly Trump's policies will mean for the economy. So far, there is no more clarity than on the day of his inauguration.

Earnings Season and Political Anxiety

In addition to the political turmoil, markets are expecting several important events next week: the US will publish new employment data, Canada will hold elections, and the state of the eurozone will be tested by important economic indicators.

The symbolic date of April 30 will be a reminder that during his 100 days in the White House, Trump has faced a host of challenges, many of which he himself provoked.

Tariff wars and diplomatic failures

The instability caused by the president's decisions to introduce and cancel trade tariffs continues to shake financial markets. Market participants have still not learned to calculate the economic risks associated with these initiatives.

Particularly surprising was the sharp cooling of relations between Trump and Ukrainian leader Volodymyr Zelensky. Ukraine's European allies, feeling excluded from peace talks with Moscow, began to urgently increase their military budgets, something that has not happened for decades.

Falling tourist flows and growing tensions with Canada

Harsh immigration policies and restrictions on tourists have dealt a blow to the US tourism industry, reducing the flow of foreign visitors.

Trump's attempt to jokingly call Canada "the 51st state of the USA" did not go unnoticed. In the neighboring country, this caused a wave of anti-American sentiment and political tension.

In search of clarity: what awaits the markets?

Old international alliances are crumbling, financial markets are filled with worrying instability, and investors need clear guidelines more than ever. The anticipation of the next stage of Trump's presidency is accompanied by increased volatility and fears of unexpected moves by the White House.

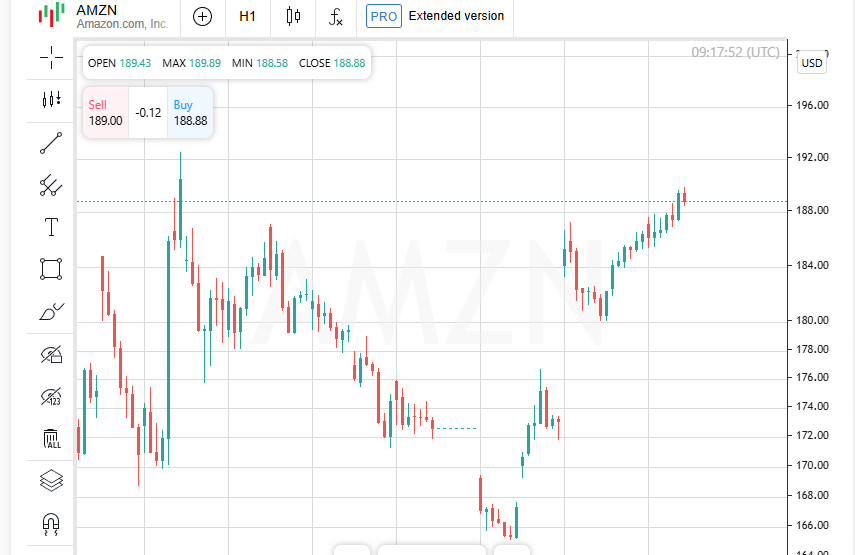

Meanwhile, the largest US corporations - Apple (AAPL.O), Microsoft (MSFT.O) and Amazon (AMZN.O) - will report their quarterly results next week. Their reports can become an important barometer for assessing the real state of the economy in the context of the new political reality.

The Magnificent Seven Start the Year on a High Note — But with Challenges

After two years of triumphant growth, large-cap stocks like Nvidia (NVDA.O), Alphabet (GOOGL.O) and Tesla (TSLA.O) face their first major test in 2025. The unfavorable market environment has already begun to put pressure on the entire stock market.

Earnings are growing, but expectations are worrying

More than 20% of the companies included in the S&P 500 index have reported their results so far. The results are encouraging: total profit for the first quarter is expected to rise by 8.4%. However, analysts are focused not on past successes, but on forecasts: in a volatile market, it is the outlook for the corporate sector that determines investor sentiment.

Labor data to provide clues

Markets will receive important benchmarks in the coming days: new inflation data will be released on May 1, and the April employment report will be released on May 2. The forecasts are quite cautious: the US non-farm payrolls are expected to add only 130,000 jobs, which is significantly less than the 228,000 in March.

Calm in the trade war: a signal from Beijing

Amid the trade battles between the US and China, a glimmer of hope has finally appeared: the Chinese authorities are considering the possibility of partially easing tariff pressure. Beijing has distributed a list of 131 product categories on social media and among business associations that could be exempt from 125% tariffs on US imports.

The move is seen as an attempt to reduce tensions that have long fueled global economic fears.

Canada Sets Course for Independence

Canadians head to the polls Monday to decide the country's future political direction. Prime Minister Mark Carney is seeking a strong mandate to resist pressure from Washington.

Carney is blunt: Trump's actions, from tariffs to annexation rhetoric, pose a grave threat to Canada. His response is to strategically reduce economic dependence on its southern neighbor and to profoundly transform the national economy.

Liberals Take Back the Lead: Carney Strengthens Position

Canadian voters appear ready to back Prime Minister Mark Carney's course. The Liberal Party, which trailed the Conservatives by 24 percentage points in January, is now ahead by 5 points.

Canadian Dollar Stable, but Challenges Remain

Financial markets are hardly surprised by the turnaround. The Canadian dollar, which suffered its biggest fall in 22 years in February, is holding up well, and even if there is political turbulence, no major shocks are expected.

However, the economic horizon remains cloudy. The International Monetary Fund recently downgraded its growth forecast for Canada, and the Liberals' stimulus spending plans threaten to turn the budget deficit into a deeper hole than previously thought.

The euro and eurozone bonds: new safe havens

With instability emanating from the US, investors are increasingly seeking refuge in European assets. The euro and eurozone bonds, previously seen as riskier investments, have begun to look safer.

The coming economic reports will help to understand how sustainable this trend is. Eurozone inflation data due on May 2 could show a further slowdown in price growth, approaching the European Central Bank's 2% target.

Manufacturing under pressure: alarming signals

The same day, the HCOB manufacturing business activity index will be published, which may confirm fears: confidence in the stability of production chains in Europe is declining.

If the data turns out to be weak, this will strengthen expectations that the eurozone economy is in a state of stagnation. However, market participants are in no hurry to panic.

The euro is taking a hit: support from Germany

Analysts are confident that even with an unfavorable macroeconomic picture, the euro will remain stable. Bank of America notes that Germany's large-scale budget expenditures will play the role of an "insurance cushion" for the currency.

Barclays, in turn, assumes that the euro will continue to trade near the $1.15 mark, unless political shocks from Washington intensify and undermine global stability.

European markets are in the green: investors are hoping for change

European stock exchanges started the week with growth, continuing the positive trend after two weeks of consecutive index increases. Investors are bracing for an eventful week of earnings and economic data, as well as news of potential tariff moves.

The broader STOXX 600 (.STOXX) gained 0.5% in early trading on Monday, reflecting market optimism. The positive sentiment also spread to other European markets, with regional indices also moving into positive territory.

Trade Hopes and Mixed Signals

Markets were encouraged last week by signs of easing trade tensions between the US and China. However, investors remain wary as messages from Washington and Beijing continue to contradict each other.

Beijing has flatly rejected Donald Trump's claims that tariff talks are ongoing. However, China's decision on Friday to exempt some US goods from 125% tariffs – delivered via formal notices to companies – was seen as a sign of government concern about the potential fallout from a protracted standoff.

Deals and Acquisitions: Stock Growth Drivers

Individual success stories supported the growth of a number of stocks. Shares of the British food delivery company Deliveroo (ROO.L) soared by 16.3% after the announcement of a purchase offer from the US giant DoorDash (DASH.O) made on April 5.

European aircraft manufacturer Airbus (AIR.PA) strengthened its positions by 1.6% after confirming a deal to acquire several assets from Spirit AeroSystems (SPR.N).

In addition, Italian bank Mediobanca (MDBI.MI) announced its intention to buy private bank Banca Generali (BGN.MI) for 6.3 billion euros (approximately $7.15 billion), which was another notable event in the European financial market.

Inflation Reports: A New Uncertainty Factor

Market participants are also focused on key inflation reports due later this week in both the eurozone and the US, which will be an important indicator of where central banks may be heading in the coming months, particularly with regard to interest rates.