Analysis of Trades and Trading Tips for the Euro

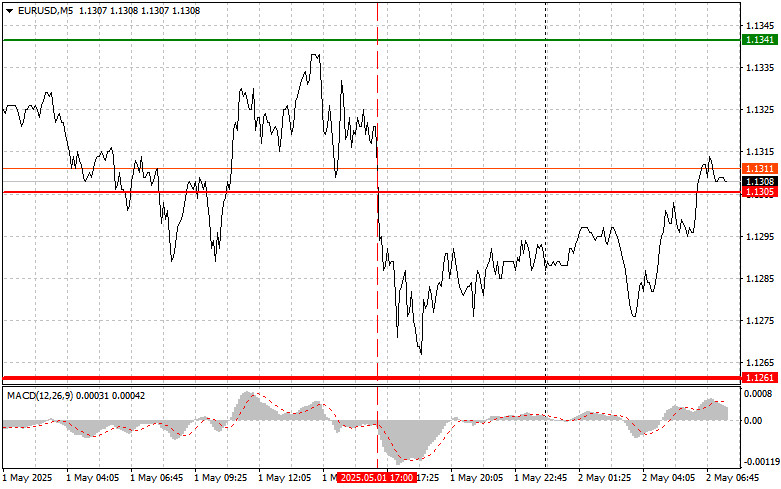

The test of the 1.1305 level in the second half of the day occurred when the MACD indicator had already moved far below the zero line, which limited the pair's downside potential. For this reason, I did not sell the euro.

Improved U.S. manufacturing activity data compared to analysts' expectations led to a significant strengthening of the U.S. dollar yesterday. The PMI index, released by the ISM Institute, came in better than economists had forecast, though still weaker than the March figures. As such, the data is unlikely to indicate any real recovery in the manufacturing sector following a period of stagnation.

Today, to renew interest in the EUR/USD pair, a series of encouraging economic reports from eurozone countries will be necessary—especially in the industrial sector, where the situation remains dire. Only strong PMI data from eurozone countries can support a recovery in the euro. A noticeable jump in this indicator would point to increased production volumes, a rise in new orders, and improved business sentiment, which in turn could lead market participants to begin buying the euro.

Inflation will also be a focus. A slowdown in the consumer price index (CPI) suggests the European Central Bank may be on track to reach its targets by year-end.

Controlled inflation allows the ECB to maintain an accommodative monetary policy, which in turn supports economic growth. Equally important is the unemployment rate. A decrease signals job creation and a healthier labor market. More employed citizens means increased consumer spending, which further supports the economy. A steady decline in unemployment would be an additional argument in favor of strengthening the euro.

A combination of favorable factors—strong PMI reports, a falling CPI, and declining unemployment—could restore demand for EUR/USD.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

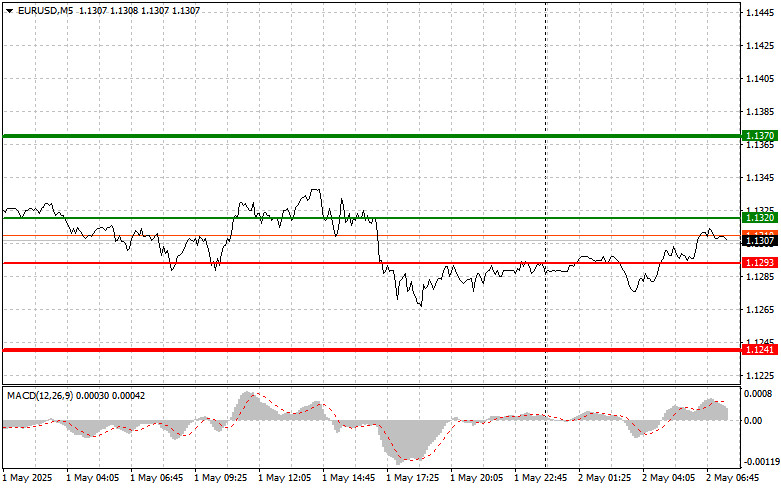

Scenario #1: Buy the euro today if the price reaches 1.1320 (green line on the chart), with a target of 1.1370. I plan to exit the market at 1.1370 and open a short position from that level, anticipating a move of 30–35 pips in the opposite direction. Expect a rise in the euro in the first half of the day only if eurozone data are strong.

Important: Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1293 level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and likely trigger a bullish reversal. A rise toward the opposite levels of 1.1320 and 1.1370 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro if its price reaches 1.1293 (red line on the chart). The target will be 1.1241, at which point I plan to exit the market and immediately open a buy position in the opposite direction, targeting a 20–25 pip move back up.

Important: Before selling, ensure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1320 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and likely trigger a bearish reversal. A drop toward 1.1293 and 1.1241 can then be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.