Hi, dear colleagues!

Following the good old tradition, we discuss the outlook for gold and other precious metals at the end of each month. Importantly, you are probably aware that growth in gold price sets the stage for the rally of precious metals. Palladium used to be an exception a few years ago because it is a low liquidity metal. So, its growth was caused entirely by demand for the auto manufacturing industry. In other words, precious metals always follow the gold dynamic at a different pace, albeit in the same trajectory. It makes sense to execute trades in opposite direction on condition you have excellent skills of arbitrage strategies. The common rule is that positions should be opened in the same direction.

Let me remind readers of the main constituents of supply and demand for gold that make a direct impact on growth or decline of gold price. The prime factor to influence gold in the short term is demand from American exchange-traded funds. The factor of secondary importance is demand from speculators trading on COMEX. In the long term, gold is sensitive to demand from the jewelry industry, investments in gold coins and bullions, and gold purchases by central banks. Demand from the high-tech sector doesn't make a significant impact on the price due to a minor 10% share in the total gold consumption.

Among other factors to make a direct impact on market quotes are developments on forex, risk-on or risk-off mood among global investors, yields of US Treasuries, inflation expectations, and a series of other little known factor such as seasonal price fluctuations. Speaking about seasonal fluctuations, multi-year research shows that gold commonly clicks into gear roughly from mid-March. The metal usually trades lower at the end of February.

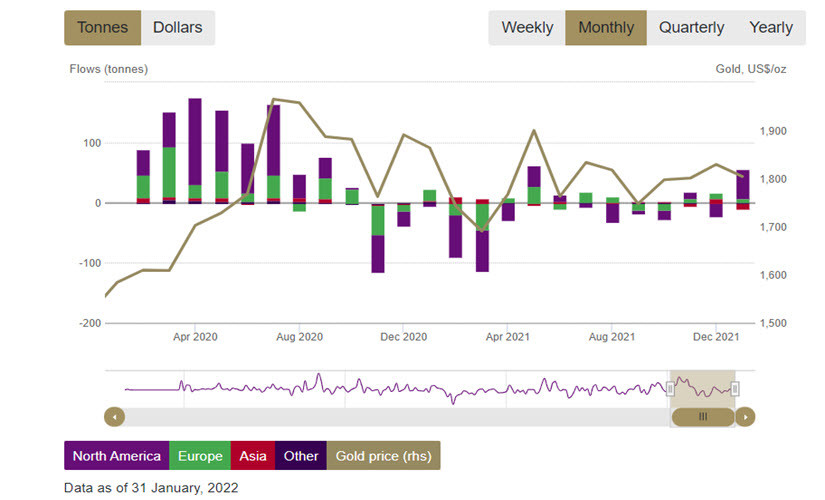

Picture 1. Demand for gold from exchange-traded funds

Now let's figure out the factor of major importance for gold. According to research by World Gold Council made in January 2022, US investors purchased 49 tons of gold in ETFs in the amount of $2.9 billion. It has been the biggest purchase since August 2020. Such a background gives us the hope for a growing investment interest driven by high inflation, geopolitical risks, and other unfavorable factors existing for the time being.

There is one more factor to encourage growth of gold prices nowadays. This factor is the sanctions imposed by the West against the Kremlin. By turning off the SWIFT system and freezing its assets, the United States and its allies did not leave the Bank of Russia the opportunity to purchase traditional assets denominated in dollars, euros, yen and pounds to replenish reserves. The current pushes the Russian regulator to accumulate reserves by buying gold and Chinese yuan. Moreover, in the future, it may be necessary to do this in much larger volumes than it was before, when the central bank bought out all the gold produced in Russia. The appearance of such a major player, hypothetically, could lead to an increase in demand, and hence to a significant increase in the price of gold.

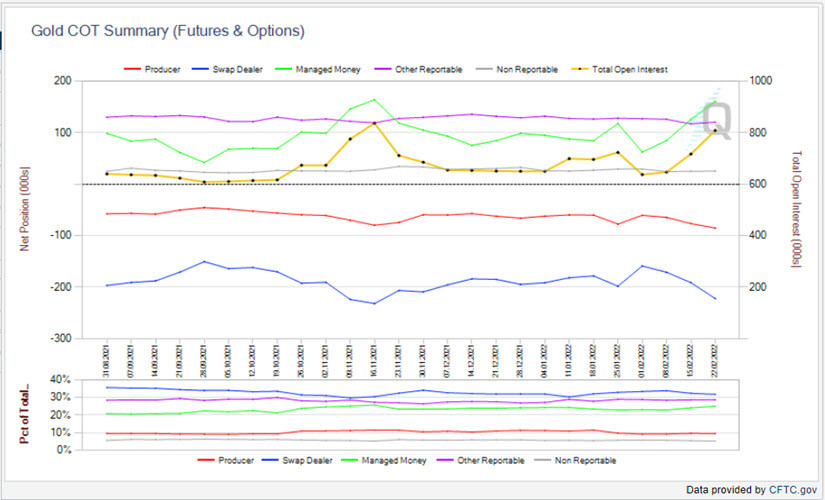

Picture 2: Graphic analysis of COT report

The COMEX-CME exchange is also seeing positive changes. The latest COT reports show a sharp increase in open interest, which is an indicator of supply and demand. In just 4 weeks, the number of open positions increased from 637K to 809K contracts. The indicators of the total interest of speculators from the Money Manager group increased from 63K to 161K contracts, which was the highest value since November 2021 and signals the potential for further growth (picture 2)

Picture 3: Technical analysis of gold

However, when it comes to potential growth, we need to isolate our thinking from the mind trap when our brains want something hypothetical to be real. This is very important, especially in the context of the fact that even knowing the direction, we often do not have an entry point and cannot open a position, just because we do not have exit points. In other words, we cannot make a decision without technical analysis, so let's look at technical analysis (picture 3).

The main point that traders and investors need to pay attention to is the price break above the resistance at $1,875, which has now become support. The rapid growth of gold to the level of $1,980 ended with equally rapid sell-offs. Now it is testing support from above, from where growth can begin again. However, the point for placing a stop order is now no higher than $1,780, which means a risk of $110 per contract. In turn, it means that the upside potential should be at least $200 and will be at the level of the previous all-time high reached by the price in August 2020. This is a feasible scenario, so long positions for this purpose are possible, but are more suitable for investors who rely on long-term holding the asset.

However, if we talk about trading, the current price level seems a bit high to me, and the stop order size is quite large. Thus, traders need to wait for the formation of a new low to place a stop order. Perhaps such a low will appear as early as this week.

Picture 4: Technical analysis of platinum

As it was said at the beginning of this article, other precious metals, platinum and silver, follow gold. In this context, from a technical point of view, in my opinion, the most interesting is platinum, which exceeded the $1,100 mark last week, but failed to gain a foothold. At the moment, platinum is testing support at $1,050. If there are signals, you will be able to buy an asset with a target of $1,300 and placing a stop order at a value not higher than $990. Be careful and follow the rules of money management!